how much state tax is deducted from the paycheck

10 on the first 9700 970. However each state specifies its own tax rates which we will cover in more detail below.

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

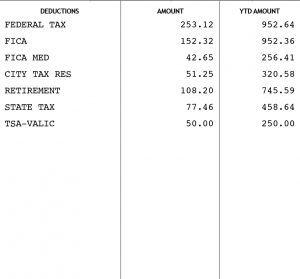

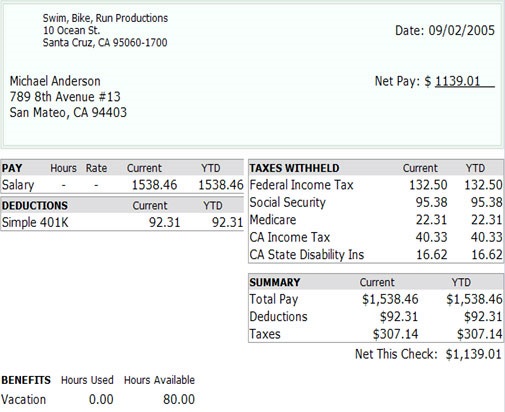

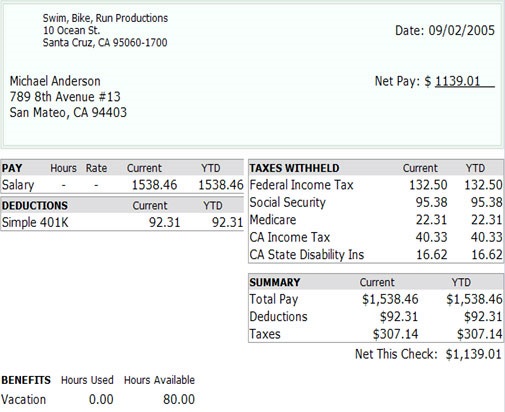

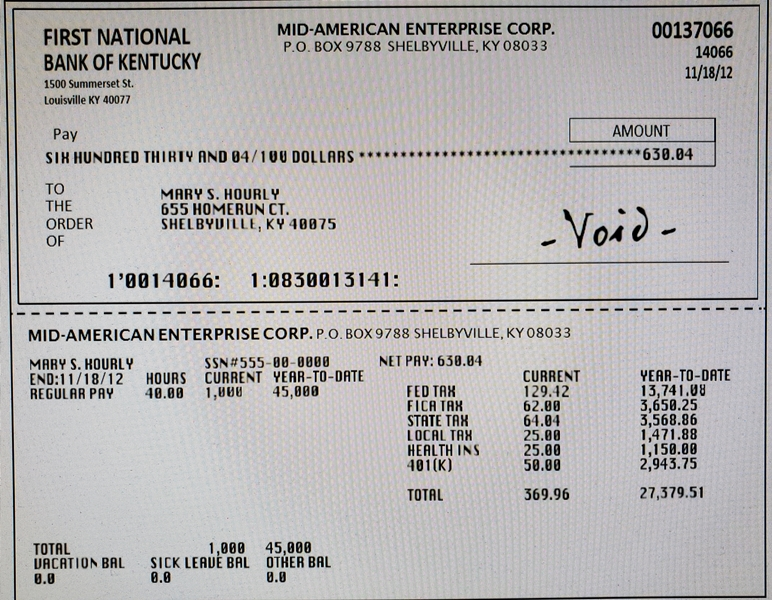

In each paycheck 62 will be withheld for Social Security taxes 62 percent of 1000 and 1450 for Medicare 145 percent of 1000.

. Paycheck Deductions for 1000 Paycheck Looking at a simple example can help clarify exactly how federal tax withholding works. The federal income tax has seven tax rates for 2020. For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions.

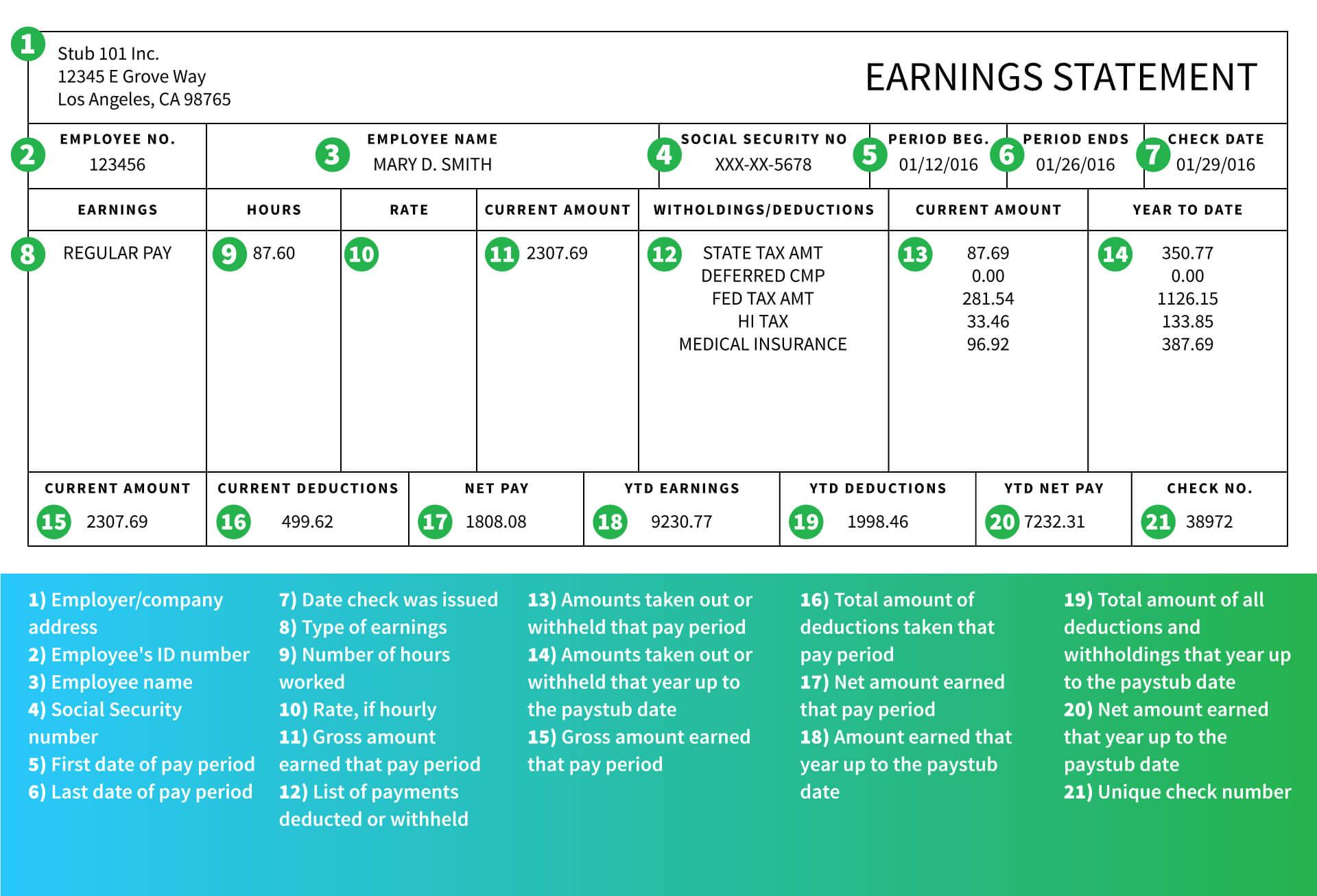

InvestigateTV - Paycheck deductions dictate how much of your money goes straight to you and how much is set aside for taxes retirement insurance and other expenses. You pay the tax on only the first 147000 of your earnings in 2022. The total value of these deductions cannot exceed 6100 for single filers and 12200 for married filing jointly.

2021 State Tax Rates Brackets Deductions and Exemptions. Depending on your filing status you pay federal income tax at a rate of 22 on your taxable income. We Help Taxpayers Get Relief From IRS Back Taxes.

6 2022 at 1113 AM PDT. How much tax is deducted from a 1000 paycheck. There is no state-level income tax so all you need to pay is federal income tax.

The deduction for state and local taxes is no longer unlimited. Wait wait hold upstate income or sales taxes. For 2022 the limit for 401 k plans is 20500.

Any income exceeding that amount will not be taxed. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. The take home pay is 4429050 for a single filer with an annual wage of 53000.

Employers must also withhold an additional 09 235 total of Medicare tax on earned income of more than 200000 in a tax year. From your paycheck the total tax constituting FICA is 29 Medicare and 124 Social security of your wages. Unfortunately you cant deduct both state income and sales tax Uncle Sam sees that as trying to stick both hands in the cookie jar.

Your employer withholds 145 of your gross income from your paycheck. State Income Tax in Florida. If a resident of Georgia is earning more than 200000 then an additional tax is also applied on the paycheck called Medicare surtax.

There are no income limits for Medicare tax so all covered wages are subject to Medicare tax. 22 on the last 10526 231572. Ad USAFacts is a non-partisan non-profit online visualization of the government.

Its important to note that there are limits to the pre-tax contribution amounts. Pennsylvania has a flat state income tax rate of 307. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax.

You can deduct the most common personal deductions to lower your taxable income. On September 30 2021 the Massachusetts Legislature adopted an elective pass-through entity excise tax in response to the federal state and local tax deduction cap of 10000. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches.

For a married couple with a combined annual of 106000 the take home page after tax is 88581. In this 09 more tax is deducted for Medicare purposes. Paycheck Deductions for 1000 Paycheck The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Free Case Review Begin Online. The amount of federal income tax an employee owes depends on their income level and filing status for example whether theyre single or married or the head of a household.

How much do you make after taxes in Florida. The state and local tax deduction allows you to deduct up to 10000 of your state and local property taxes as well as your state income or sales taxes. Your employer pays an additional 145 the employer part of the Medicare tax.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The state and local tax deduction allows you to deduct up to. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

You will also need to consider the. Ad See If You Qualify For IRS Fresh Start Program. At one time you could deduct as much as you paid in taxes but TCJA limits the SALT deduction to 10000 or just 5000 if youre married but file a separate tax return.

Many range between 1 and 10. Youd pay a total of 685860 in. For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount.

If youre single and you make 50000 after subtracting deductions exemptions etc you would pay. State income tax rates tend to be lower than federal tax rates. How Much FICA Tax Is Deducted In Ga.

This cap applies to state income taxes local income taxes and property taxes combined. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS. How much tax is deducted from a 1000 paycheck.

Overview of Pennsylvania Taxes. USAFacts is a non-partisan non-profit resource that puts the power of. Planning your deductions could put more money from each paycheck into your wallet while also ensuring you do not owe taxes when you file.

Be careful not to deduct too much Social Security tax from high-income employees since Social Security is capped each year with the maximum amount being set by the Social Security Administration. Paycheck Deductions Payroll Taxes. You can combine property.

For tax years beginning on or after January 1 2021 certain qualifying pass-through entities may elect to pay a new-entity level excise tax on qualified. What percentage is state income tax. 12 on the next 29774 357288.

Understanding Your Pay Statement Office Of Human Resources

Paycheck Taxes Federal State Local Withholding H R Block

How To Read A Pay Stub Gobankingrates

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Pay Stub Meaning What It Is And What To Include On A Pay Stub

Understanding Your Paycheck Taxes Withholdings More Supermoney

What Are Payroll Deductions Article

Different Types Of Payroll Deductions Gusto

What Everything On Your Pay Stub Means Money

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Solved Look At The Check Below And Answer The Following Chegg Com

Paycheck Calculator Online For Per Pay Period Create W 4

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

California Paycheck Calculator Smartasset

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest